Foreign tourists visiting the Philippines now have an exciting reason to shop more! On Monday, government officials signed the official rules and regulations for the VAT Refund for Non-Resident Tourists, allowing foreign visitors to claim a refund on value-added tax (VAT) for goods purchased from accredited stores.

Who Can Get a VAT Refund?

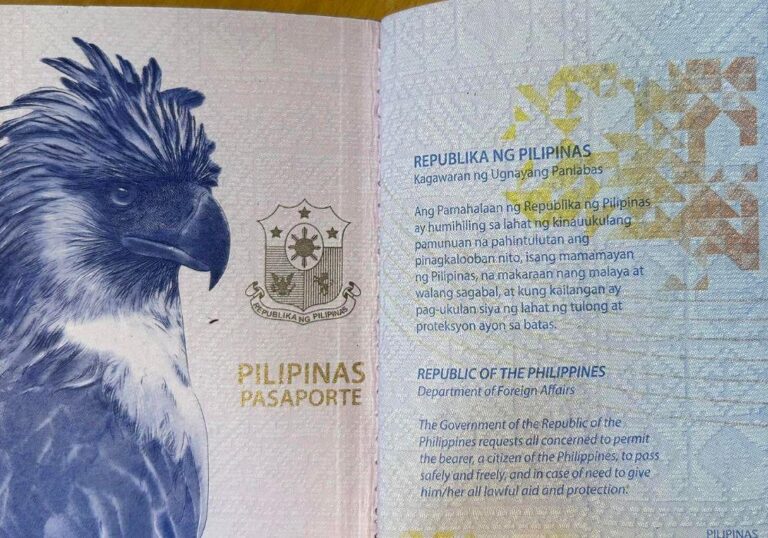

Under Republic Act 12079, tourists holding a foreign passport can apply for a VAT refund if they spend at least ₱3,000 on eligible goods. However, these items must be taken out of the country within 60 days of purchase.

How Will It Work?

-

The Philippine government will partner with trusted international VAT refund operators to ensure a smooth refund process.

-

Refunds may be given electronically or in cash, providing convenience for tourists.

Why Is This a Big Deal?

Finance Secretary Ralph Recto emphasized that the VAT refund system is designed to attract more tourists, encourage them to stay longer, and spend more in the country.

Boosting the Philippines as a Shopping Haven

The initiative follows President Ferdinand “Bongbong” Marcos Jr.’s push to promote the Philippines as a top shopping and travel destination. The goal? To ensure tourists leave the country with more than just souvenirs—but also a great experience and a desire to return!

With this new VAT refund system, shopping in the Philippines just got even more exciting!